How I paid off $47,000 of debt in 20 months

In October 2018, I travelled to Greece and had the most amazing solo trip. On my flight back to Toronto, I started thinking about my future and the goals I wanted to accomplish. I was turning 30 the next year and decided to write a list of 30 things I wanted to achieve before 30. Halfway down my list, I realized something was missing. I was not financially secure. I had credit card debt that was piling up and little to no savings. So I decided to instead focus on my finances for the next year.

A week later, my car battery died. The mechanic said It would cost me $300 to replace it. I did not have $300 in my bank account! I had to borrow $300 from a work friend. I was so embarrassed, and I resolved to get my finances in order.

I compiled all my debt and bought books on how to pay off debt, such as The Financial Diet, The Total Money Makeover, and Money Rules. I created a plan to pay it off in three years. I was ready!

Then I was hit with another curveball. I walked into the office and was ushered into the boardroom by two managers. They gave a speech about how they had to make budget cuts, and I was being laid off. I blanked out during the conversation because I kept thinking about my debt and how I could not pay it off now that I’d lost my job. So here I was, $47,000 in debt with no savings and no job. I was devastated, which became the point of no return to get my money right. I knew I never wanted to experience that feeling of fear and insecurity around my finances.

In January 2019, I started a new job and aggressively tackled my debt until it was paid off in August 2020. In this blog post, I will share how I did it with you.

I got clear on my WHY

Before getting laid off, I had made several attempts to be debt-free. I would pay off a credit card, and two months later, I’ll rack up debt again. I didn’t have any real motivation to pay off my debt other than - It was what I was supposed to do. But the feeling of losing my job without financial security gave me a clear reason why I wanted to become debt free. I knew I wanted Financial security and the peace that comes with knowing you don’t owe anyone. I wanted an emergency fund I could rely on if I lost my job. So that became my driving force and motivation to attack my debt with a vengeance

I knew exactly how much I owed

I never took my debt seriously because I didn’t know exactly how much I owed. In my head, I owed about 20K because I was only focusing on my credit card limits which I knew were all maxed out.

Then I pulled out all my recent statements and compiled my debt, and It came out to a whopping $46,809. I had two personal loans from the money I had borrowed from friends and added that to the pile, and my total debt came out to $47, 328.24. I cried when I saw that number. I was in utter disbelief at how much debt I was in, and it made me more determined to pay it off.

I dug deeper to understand how I got into debt

I kept asking myself, “How did I get here.” I always thought I was financially savvy because I read many books and knew, in theory, everything I was supposed to do to manage my finances, but I still somehow got into debt. I needed to understand the underlying reason why I got into debt. So I gathered all my credit card statements from the past year and combed through every purchase. I focused on the bigger purchases and asked myself why I decided to go into debt for these purchases instead of saving. I discovered that there were two main reasons:

Lifestyle Inflation: As an immigrant, I spent my first few years in Canada hustling HARD and shuffling multiple high-stress but low-paying jobs. So when I finally landed my first big girl job, I was ready to level up and leave the struggle behind. I moved into a big condo, financed high-end furniture for $5,000, changed my wardrobe, booked multiple trips and financed a brand-new car for $32,000. I lived my best life on credit, and my bank account wept. When I dug deeper into why I let lifestyle inflation creep in, it was because I was tired of struggling, and part of me wanted to paint an image of success to my family and friends.

Money Trauma: Growing up, my parents provided everything for us, from the best education to a comfortable home. But we weren’t rich; we just had enough. So I never had birthday celebrations or fancy toys. I heard NO so many times that I resolved to get a high-paying job so I could get myself anything I wanted. This manifested in my life where If I wanted anything, I got it and damned the consequences..which was a steaming pile of debt.

False sense of security: I was earning $75,000, which was almost double my previous income, and I had this false sense of security that my supposedly high income would protect me if something bad happened. I also got into the habit of putting purchases on my credit card with the intention of paying it off with my next paycheque. This went on for a while until my credit card bill was higher than my discretionary income, and my debt spiralled out of control.

I uncovered my spending triggers

While going through my credit card statements, I paid attention to months when there was a spike in my spending and asked myself what was going on during that month that led to an increase in spending. How was I feeling emotionally and mentally? Was there a special event? I started to find a pattern and realized that some of my spending triggers were:

Travel: The months when I went on a trip was when I saw the biggest spike in my spending. I love to travel and explore new cities and cultures, and this is an expensive hobby. From flights to accommodation, food, transportation and excursions. I also had a habit of buying brand-new clothes, accessories, shoes and underwear every time I travelled. On my last trip to Greece, I financed a new camera. All of this was unnecessary, and looking back, I could have created a sinking fund and saved longer for these expenses instead of putting them on my credit card.

Stress: My job was demanding, and I was constantly stressed out. Whenever I was feeling burnt out, I would book a vacation or go on a road trip. I indulged in self-care and will have skincare hauls. I also have this strong urge to redecorate my apartment anytime I feel stressed. My home is my oasis, so I felt I needed to make it more comfortable so I could feel less stressed. This involved multiple trips to Homesense, Winners, Bouclair and Pier1. I redecorated my condo so many times that any time my friends visited, they thought I had moved to a new place.

Social Media Influence: Ngl, I am easily influenced. I can’t tell you the number of times I purchased something I didn’t need because I saw an ad for it or my favourite influencer using it. Once I click on the product, it’s like the universe keeps dropping hints on how it will change my life, and after I purchased it, I realize it was a waste of money.

Favourite stores: Sephora, Zara, Bath and Body Works, David’s Tea, Homesense and Winners had me in a chokehold. Whenever I walked into those stores, even though I was just “browsing,” I always walked out with my hands full. They always had amazing finds that I couldn’t resist and fed my urge to live a soft life of comfort

I put controls to help manage my spending triggers

Now that I knew what my spending triggers were, I had to look for proactive ways to prevent myself from spending whenever I felt the urge. To manage my stress, I used my work health benefits to book monthly visits for massages, a chiropractor and a therapist. This helped me manage my stress as I had better coping tools. I created room in my budget to indulge in self-care; this way, I didn’t feel deprived. I created a Travel Sinking Fund to help me save for travel-related expenses and did not travel until I had paid off all my debt; instead, I booked low-cost staycations.

I created a S.M.A.R.T goal

Getting laid off from my job was a blessing in disguise because it meant I could negotiate a higher salary. I knew I wanted to be debt-free in three years and to accomplish this, I would need to make an extra monthly payment of $1,300 towards my debt. This meant I needed to be earning at least $85,000. I told my recruiter I wouldn’t accept anything less than 85K, and I got an offer for 86K! So I created a S.M.A.R.T goal to help me stay on track, and it looked like this:

Specific - My goal is to pay off $47, 328.24 of debt.

Measurable - To do this, I will need to make monthly payments of $1,315.

Achievable - To achieve this, I will add my extra payments to my monthly budget and prioritize my debt payments for the next three years.

Relevant - I want to be debt-free because financial security and peace are important to me. I no longer want to live in financial fear and uncertainty.

Time Bound - I will be debt-free in 36 months. My debt-free date will be December 31st, 2021.

I used the debt tornado method

I read several books on how to pay off debt, and there were two main debt pay-off methods discussed:

The debt snowball (listing your debt from the smallest to lowest balance) and

The debt avalanche (listing your debt from the highest to lowest interest rate)

Each author made a strong case for which method was better, and I couldn’t decide which method to choose, so I created my own method: The debt tornado (listing your debt in order of annoyance).

I had a lot of guilt and shame surrounding my debt, and in order for me to feel less stressed, I had to focus on the debt that annoyed me the most while combining the debt snowball and avalanche.

This is the order in which I paid off my debt:

Using the debt tornado method gave me many quick wins, which helped me stay motivated to keep attacking my debt.

I stopped borrowing

One of the controls I put in place to help manage my spending triggers was to cut up my credit cards. I stopped using my credit cards and stopped all borrowing. Doing this allowed me to pay off my debt faster as I wasn’t adding to my balance. It also helped instill discipline in me and helped me no longer rely on credit cards.

Instead of credit cards, I used a prepaid credit card from KOHO for transactions that required a credit card, but the difference is I was spending from my bank balance instead of borrowing.

I created a budget

I had dabbled with budgets but never figured out how to stick to one. But I got creative because I was motivated to pay off debt quickly. I budgeted each paycheque and reviewed my budget on payday to ensure I had allocated every dollar of my income. After paying all my bills and living expenses, I threw any extra cash left toward my debt. I allocated 54% of my income toward debt payments in some months.

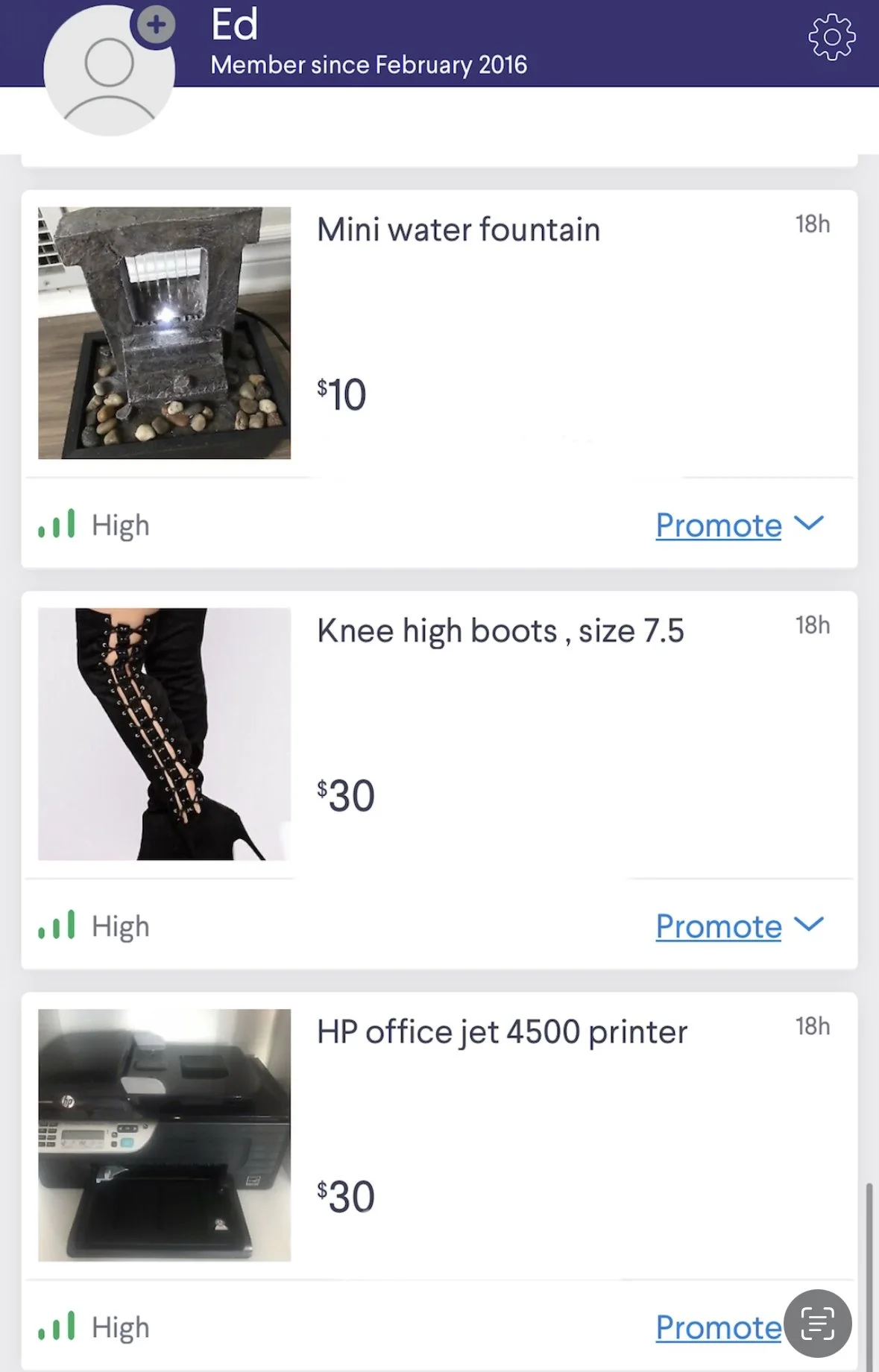

I sold my junk

I was desperate to pay off debt quickly, so I did whatever was within my power. Anything that didn’t get used in the last three months got sold. I was even tempted to sell my couch and sit on the floor 😆. I used the money from the sale to start a mini emergency fund and pay off my debt faster.

I worked extra hours

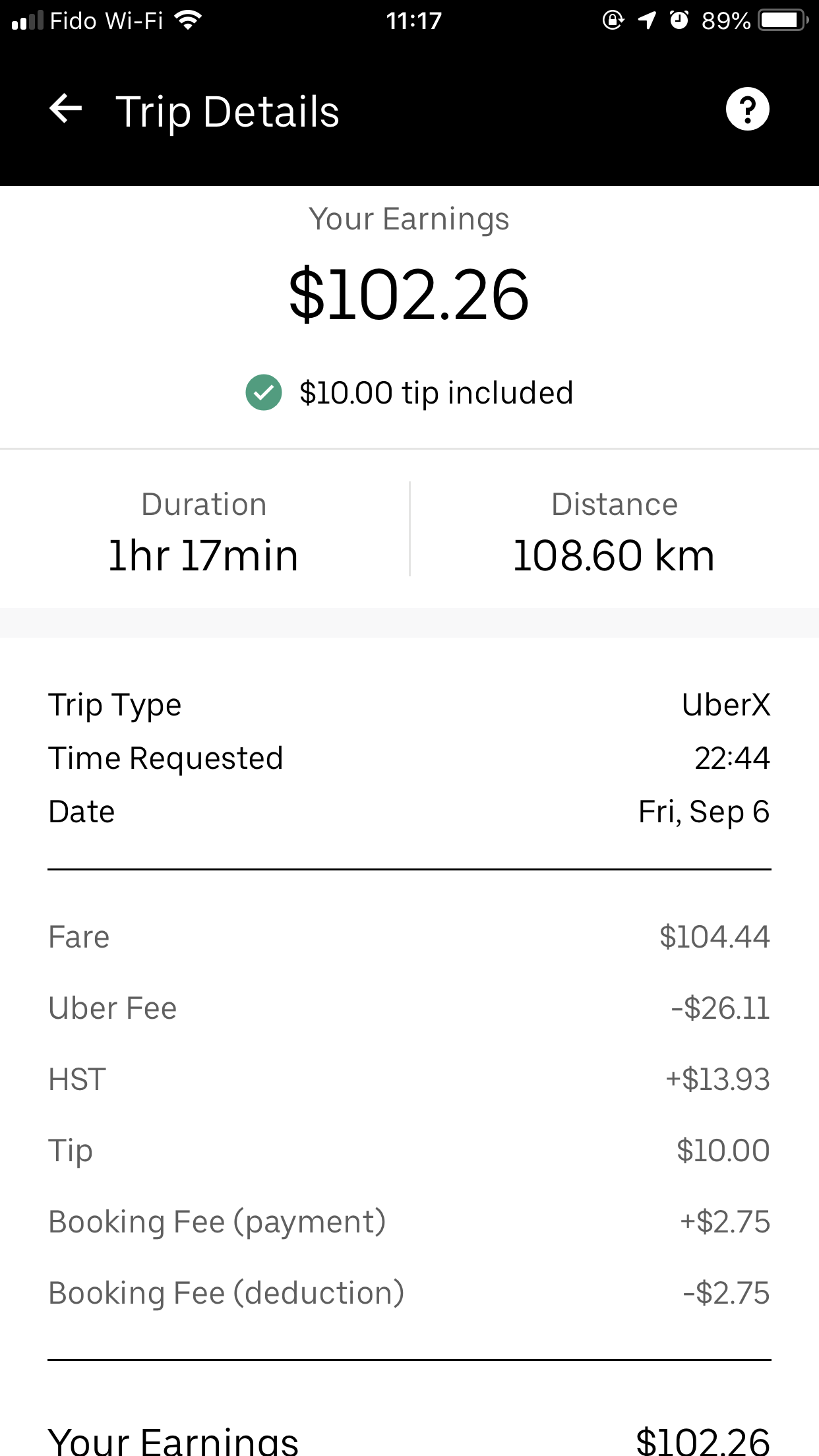

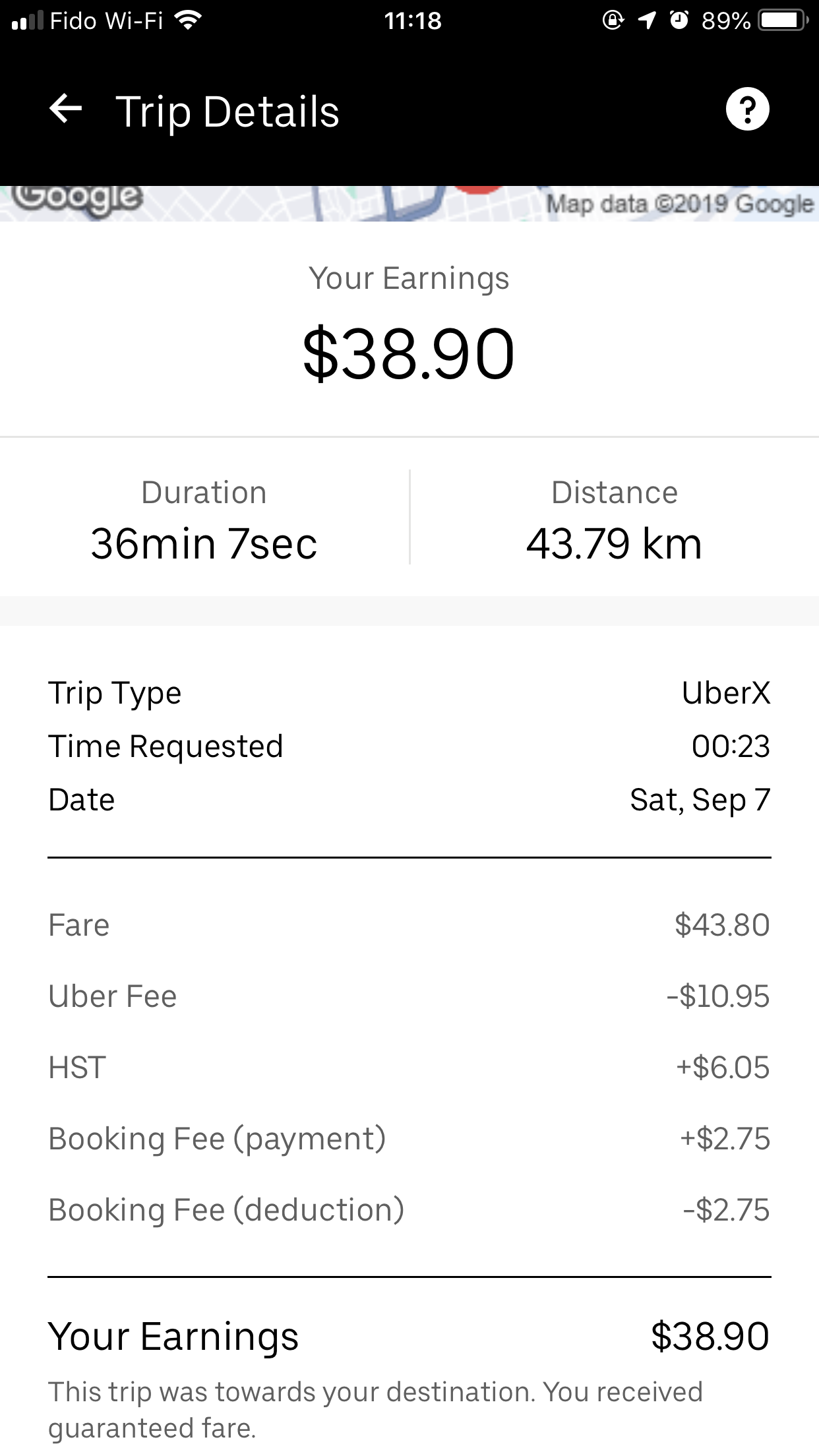

Lucky for me, I was in the launch phase of my product at work, which required lots of paid overtime. I worked extra hours most days. There was a day when I worked 16 hours! I was bringing in an extra $500 - $1,000 with overtime most months. I also drove Uber on days when work was slow, and couldn’t justify the overtime.

I reduced my spending

I lived on a tight budget for those 20 months that I was paying down debt because I wanted every dollar I could squeeze to go to my debt payments.

I didn’t buy any new clothing for two years.

I didn’t travel

I reduced my skincare budget

I cooked my meals and barely ate out

I cancelled any subscription I didn’t use daily.

Reducing my spending created room in my budget to make extra payments toward my debt.

I used cash

Knowing that I have the tendency to overspend and spend on impulse whenever I use a credit card, I had to set a boundary that would prevent me from spending outside of my budget. For my variable expenses like groceries, gas, eating out and personal care, I would spend only cash. This forced me to stick to my budget. I have multiple compartments in my wallet that I labelled with each category to ensure I don’t get the cash mixed up.

I created a mini emergency fund

Knowing I had three years to pay off debt, I couldn’t afford to wait until I was debt free before building an emergency fund. I also couldn’t afford to have a fully funded emergency fund, so I built a mini emergency fund instead. I saved $1,000 as my mini emergency fund and $500 for any car emergencies. This helped me take care of any small emergencies that came up without going back into debt.

I tracked my progress

I’m the type that gets bored and moves on from something if I don’t see any progress. Tracking my debt progress helped me stay motivated because I could visualize how much debt I had paid off. I had a thermometer on my fridge where I tracked every 5% of debt I had paid off. I looked forward to the days when I could colour in a new line and would stretch my budget and throw in a few extra payments just so I could hit the next milestone. I also tracked my progress using spreadsheets where I could see how much debt I had paid off, how much interest I had paid and my debt-free date. I loved seeing my debt-free date get shorter every month I made an extra payment.

I got accountable

The debt-free journey can be lonely, and giving up is easy when no end is in sight. Finding someone to hold you accountable makes a world of difference. My friend Chite was also on her debt-free journey, so we held each other accountable and started a podcast. Fun fact, that’s how Two Sides of a Dime was birthed! Then I created an Instagram page and shared my progress each month. A few people reached out to say my journey motivated them to pay off debt, so I knew I had to keep going even on days when I felt like giving up. Knowing that my tiny Instagram world was watching was a great way to stay accountable.

Paying off debt isn’t easy, and you’ll encounter setbacks that might send you over the edge, but the only way to become debt free is if you keep going and do not give up. Give yourself lots of grace, forgive yourself quickly and remember your why. I promise you the feeling of peace and freedom is worth it!

Free resourcesTOP CATEGORIESFAVORITE POSTSKeep reading the latest posts