ATTENTION corporate LEADERSImprove the financial well-being of your team

Equip them with the tools to master their money and retire comfortably.

My educational and practical workshops empower attendees to improve their financial well-being and prepare for retirement. This alleviates financial stress and boosts productivity, retention and overall profitability for your organization.

let's face itMerely relying on a paycheque to keep your team members committed to your organization is not a foolproof retention strategy

Financial stress is a widespread issue impacting workplaces worldwide. Employees struggle with juggling bills, managing debt, and worrying about their retirement, all while trying to excel in their roles.

But here's the kicker: financial stress isn't just a personal problem; it affects the organization as a whole.

When your team members are worried about their finances, it seeps into every aspect of their professional lives. Productivity dwindles, absenteeism rises, and morale takes a hit. Ultimately, your organization's bottom line suffers.

But it doesn't have to be this way.

Imagine a workplace where your employees are empowered with the knowledge and tools to master their finances confidently. Picture a team that's focused, engaged, and financially secure, ready to take on any challenge.

That's where I come in.

Through my financial literacy sessions, I provide a solution to the financial stress plaguing your organization. I offer a proven framework for money mastery, guiding your team through the steps to take control of their finances and retire comfortably.

By investing in financial education for your team, you're not just addressing a problem; you're fostering a culture of financial self-sufficiency and well-being within your organization.

Imagine the impact: increased productivity, low turnover rates, and financial success for everyone involved.

GET READY TO reap these benefits✦ Enhanced Well-being. Financial stress can significantly impact mental health. By equipping your team with the knowledge and skills to manage their finances effectively, you contribute to a healthier and more resilient workforce.

✦ Improved Productivity. Team members burdened with financial worries may struggle to concentrate on their tasks, leading to decreased productivity. By providing workshops that empower individuals to take control of their finances, you help alleviate this distraction, enabling team members to focus more effectively on their work.

✦ Increased Retention. When individuals feel supported by their employer in areas beyond their job responsibilities, they are more likely to feel valued and engaged. This, in turn, can contribute to higher levels of employee satisfaction and retention.

✦ Attract Top Talent. In today's competitive job market, candidates are increasingly looking beyond salary and traditional benefits. Companies that offer comprehensive employee development programs, including financial literacy workshops, stand out as employers of choice. By investing in the financial well-being of your team, you enhance your organization's attractiveness to top talent.

✦ Long-term Financial Stability. When employees understand how to manage their money effectively, they are better positioned to make informed financial decisions. This, in turn, contributes to greater financial stability for both employees and the organization as a whole.

Hi, I'm Eduek,

Engineer, Financial Educator, Speaker and Trauma of Money Certified Coach.

I HAVE LED MANY FINANCIAL EDUCATION SESSIONS THAT HAVE HELPED PEOPLE OF ALL BACKGROUNDS MANAGE THEIR FINANCES BETTER.

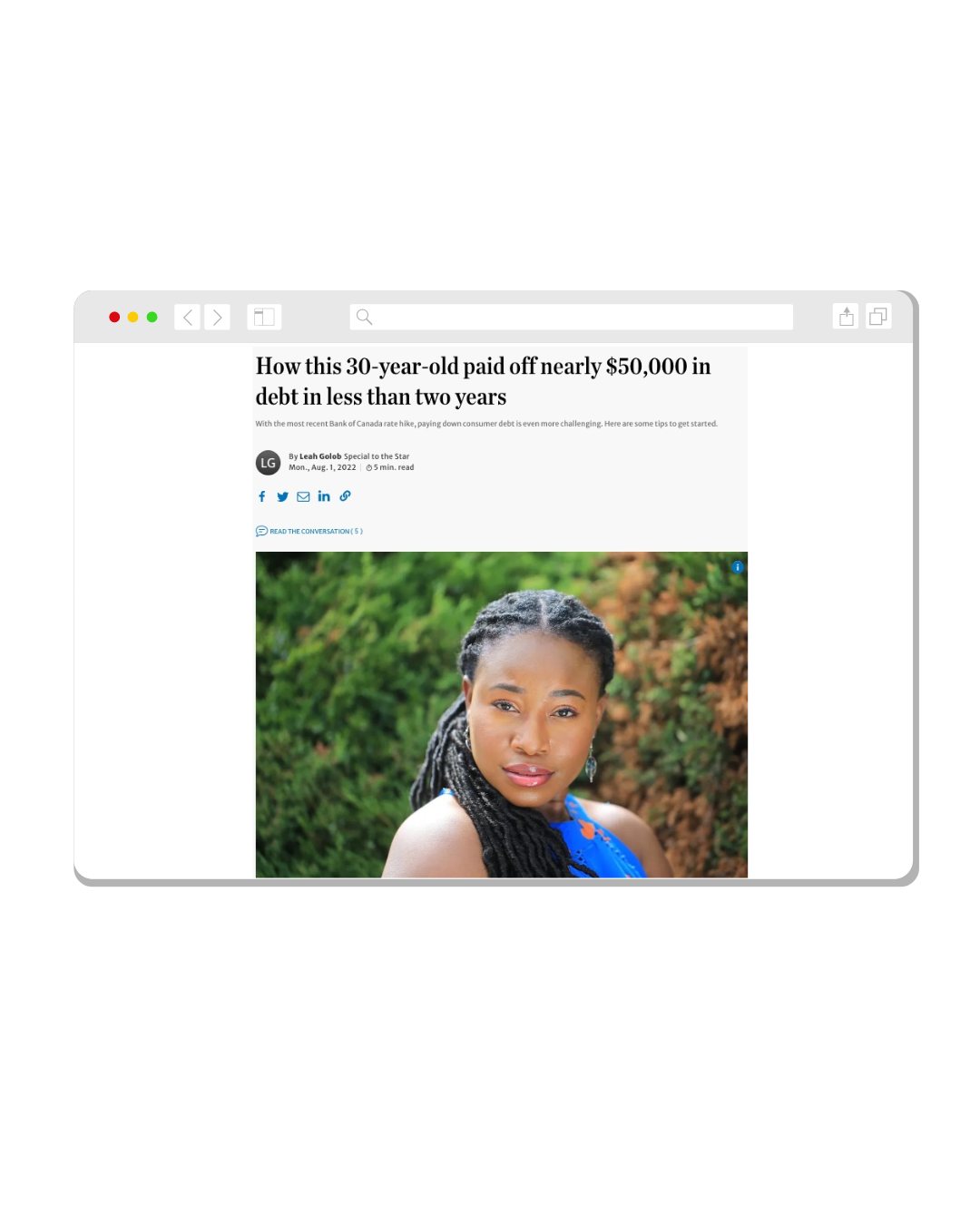

I used to be a burnt-out employee who was $47,000 in debt. Constantly worrying about the state of my finances negatively impacted my mental health and affected my job performance. Since then, I have successfully paid off my debt and grown my investment portfolio, which has me on track to retire in my 40s. Now, I am committed to partnering with organizational leaders to teach people how to take control of their finances so they can enjoy a better quality of life.

During my keynotes and workshops, I provide actionable steps on how to create a realistic spending plan, improve your relationship with money, save for emergencies, pay off debt and build a comfortable retirement plan.

My presentations are known to be insightful, interactive, easy to digest and provide real-world examples that resonate with audiences, making them seamless to implement.

If you’re ready to host a financial literacy session to help your attendees take control of their finances and leave them raving about your event for days, invite me to speak.

WHAT SETS ME APART AS A SPEAKER

01

SIMPLIFYING COMPLEX TOPICS

In my community of 15,000+ women, I am known for breaking down complex finance topics using engaging visuals and plain language that is easy to understand. After my presentations, attendees always walk away with actionable steps they can implement immediately.

02

LEADING WITH EMPATHY

As a Black immigrant woman, I know firsthand how hard it is to find financial advice related to my experiences. Most financial advice is heavily tone-deaf and does not offer lasting solutions. I’ve lived both a challenging and lavish life, so I know the struggles most people face when managing their finances. So, I provide practical solutions that lead with empathy and lots of grace.

03

TRUSTWORTHY RESOURCES

People looking to switch to a new financial product or service come to me first to get my unbiased opinion. My audience trusts me greatly, as I take the time to research products to ensure they are the right fit for my audience, and I never recommend a product I do not love, or that doesn’t benefit my audience.

Signature Topics

MASTER YOUR M.O.N.E.Y

Live intentionally, retire comfortably.

Learn the five steps to take control of your finances and retire comfortably. Attendees will walk away with actionable steps on how to improve their relationship with money, create a realistic spending plan they love, pay off debt, build an emergency fund and retire comfortably.

G E T R E A D Y T O:

✦ Master your Money Mindset: Uncover your money scripts and improve your relationship with money.

✦ Optimize Cash Flow: Learn how to create money systems to ensure that all your bills get paid and you have enough to save, invest and enjoy.

✦ Nix Debt: Create a debt pay-off strategy that will help you pay off debt fast and feel at peace again.

✦ Establish Security: Building savings that will cover unforeseen emergencies and give you peace of mind.

✦ Yield Financial Independence: Learn how to build an investment portfolio that you can retire on.

S.T.A.C.K MY DIME

Build a F.I.R.M™ investment portfolio that weathers market fluctuations.

Learn the five steps on how to build a profitable investment portfolio. Attendees will walk away with actionable steps on how to purchase their first investment.

G E T R E A D Y T O:

✦ Start with the basics: Learn the importance of investing and key terminologies to improve your understanding of investing.

✦ Take advantage: Learn how to choose between registered accounts such as RRSP and TFSA so you can save taxes.

✦ Allocate assets: Learn how to calculate your Risk Score™ and calculate your asset allocation to minimize risk

✦ Create a solid portfolio: Learn about the building blocks of a F.I.R.M™ portfolio, what to look for when choosing investments and how to purchase your first investment.

✦ Know your fees: Investment fees eat into your gains. Learn how to spot these fees so you can maximize your returns.

CUSTOM TOPIC

A customized topic to align with your audience’s needs or the theme of your event.

If you have a different topic you want me to speak on that better aligns with your audience’s needs or the theme of your event, let’s chat.

KEY AREAS I FOCUS ON:

✦ Self-directed Investing

✦ Debt-payoff

✦ Money Mindset

✦ Money Systems

✦ Money management for Solopreneurs

Organizations I’ve spoken at

Speaking Engagements

-

🎤Pay off my dime

🎤Budget my dime

🎤Stack my dime

-

🎤Giving a dime about my money: Four things to do to take control of your finances today.

-

🎤Financial Literacy Mega Event: RRSPs & TFSAs.

-

🎤Reset your Finances in 2022

-

🎤Investing for RESTirement.

-

🎤Giving a dime about my money: Four things to do to take control of your finances today.

🎤How to invest your first $1,000.

-

🎤How to build an investment portfolio that withstands volatility

-

🎤Panelist - Career success in 2023: How young people can ‘ignite’ their full potential.

-

🎤Project UP - Budgeting and paying off student loans

Media and Guest features

Online Creator Podcast

For what It’s Worth

Chelsea on CHED

Spirit School

Don’t Go Broke Trying

The Financial Key

Don’t Go Broke Trying

It’s Not A Straight Line

From paying of $47,000 of debt in 2 years to Financial Educator

SPEKAER BIOEduek Brooks

Financial Educator, Coach and Speaker

Eduek Brooks is a Financial Educator who has helped more than 200 women take control of their finances and prepare for a comfortable retirement. Her insights simplify the complexities of personal finance while challenging traditional norms and have been featured on Global News, the Toronto Star, and several other media outlets. The Minister of Finance has invited her multiple times to simplify the details of the Federal Budget for Canadians.

Through her money framework, she has enabled career professionals and solopreneurs to save and invest over $1 million. Her ultimate goal is to help at least 100,000 women invest $100,000. By working with her, you can gain confidence in your daily money management system, decrease financial stress, and increase overall satisfaction in life because you know your money is serving you.

FREE RESOURCE

The Mindful Spending Guide.

Stop overspending, achieve financial freedom and enjoy your money guilt-free.

This comprehensive guide to mindful spending is designed to help you spend intentionally, so you can save money, reduce stress, and achieve your financial goals. From creating a spending plan to identifying your spending triggers, you'll learn specific tips and strategies for how to be more intentional with your money. Say goodbye to financial stress and guilt, and hello to a mindful approach to managing your money.

Download now to take control of your finances and start living a life you love.