What to do during a recession

THE STACK #15These days, it’s hard to ignore the doom and gloom in the news.

Some financial analysts are calling for a recession, and while their predictions are mostly wrong🙄 it’s better to be prepared (both mentally and financially) than to be surprised.

A lot of what you hear lately is :

😑 Buy the dip

😑 Don’t time the market

😑 Wealth is made in a recession

But all of that is nonsense talk and not realistic or even practical.

So here’s my hot take. 👇🏾 👇🏾

THE STACK

First of all, what is a recession?

A recession is when a country experiences two consecutive quarters of a declining GDP (Gross Domestic Product).

A recession is triggered by a drop in spending, leading to cutbacks in production, jobs and income.

This hurts sales, leading to further cutbacks in production, and the cycle continues.

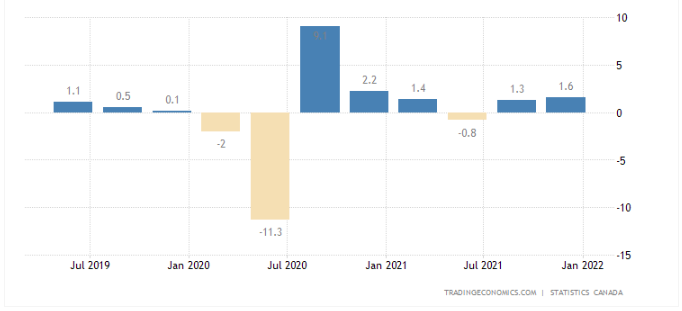

GDP for US and CANADA

The US saw a negative GDP of -1.4% in the first quarter of 2022, and the current forecasts aren't looking too great right now.

So what should you do during a recession?

1. It's ok to panic

Contrary to what all the tik tok finance bros will have you believe, fear is a normal human reaction.

It's ok to have some form of fear when the economy and stock market are going down the toilet.

But you shouldn't act from a place of fear but from a place of information.

Ensure that you fully understand what's going on, why the country is in a recession, the areas of the economy that will be impacted the most, why your investments are down etc.. before acting.

2. Build your emergency reserve

Your priority should be building your emergency fund or topping it up to a comfortable number.

Most recessions are a result of or lead to mass unemployment.

No one truly knows how long it might last; It could last one month, a year, or more.

So having an emergency fund will be helpful to keep you afloat and protect your investments longer.

3. Focus on surviving

After your emergency fund has been beefed up, you should focus on getting by. You may be down to one income or no income.

Try to do what you can to get through the recession, and this might look like putting a pause on some of your wants like travelling etc..and just focusing on the essentials.

4. It's ok to sell your investments to survive

As much as I'll hate to tell you to sell at a loss, it's ok to do so as a last resort.

Remember, the goal is to survive and get through the recession.

It's not going to be the end of the world if you sell your investments to buy food...unless it is indeed the end of the world, then we're all collectively doomed, and your investments still won't matter.

5. Timing is everything

Everyone says don't time the market, but timing is everything in a recession!

The best time to get back into the market is during the accumulation and mark-up stages.

Buying during the mark-down stages will only lead to more losses and may take longer for your portfolio to recover fully.

6. Dollar cost average

I'll admit that finding an entry point back into the market is extremely hard to predict, as the market can recover quickly overnight.

A good alternative will be to Dollar Cost Average (buy investments regularly at a fixed amount).

This will help reduce the volatility or any sharp losses.

7. Reassess your risk tolerance

This will be an excellent time to reassess your investment strategy and risk tolerance.

Some people think they have a higher risk tolerance, but you never truly know your risk tolerance until you see how your investments perform during a market downturn.

If the constant losses make you lose sleep, you'll need to readjust your portfolio to something less aggressive after the market recovers.

8. Look to the defensive stocks

Look to the companies that perform well during the recession.

These are usually defensive stocks, which are from companies or industries that are essential to the economy.

Diversify your investments with these types of stocks or their ETF equivalent.

This will help protect your portfolio if the economy takes a nosedive.

9. Don't skip the fundamentals even when buying the dip

Buying the dip isn't always the best strategy.

The overall stock market eventually recovers, but depending on how long the recession lasts, not all companies will recover from a recession.

Most companies use shareholder equity to grow their business. However, during a recession, the influx of cash is usually low, and most companies will struggle to keep their doors open.

Fundamental analysis is very crucial here.

Make sure you're buying quality companies with solid financials; if you're lucky, you'll get these at a discount.

THE TOOL

FUNDAMENTAL ANALYSIS TOOL

I love using TradingView for a quick one-stop analysis of companies.

It shows the stocks' performance, profitability and a few financial ratios.

If you buy individual stocks, you need this tool.

THE ACCOUNTABILITY

Do you have an emergency fund in place?

Now will be an excellent time to start saving.

As a business owner, I plan to save at least one year of essential expenses in a High-interest Savings Account.

How many months are you planning to save?

THE COURAGE

THE KNOWLEDGE

BULL MARKET

A bull market is when the stock market price rises and is expected to continue to rise over an extended period.

A bull market sees an increase of at least 20% and can last six months to several years.

BEAR MARKET

A bear market is when the stock market's price is falling and is expected to continue to fall over an extended period.

A bear market sees a decrease of at least 20% and can last two months to a few years.

A prolonged bear market can lead to a recession.

That's it for this week's STACK!

Talk to you next week,

But until then...Keep Stacking!

about the newsletterEvery Saturday, subscribers will receive one money tip, one tool, one actionable step, one word of courage and learn a new finance term to help you gain control of your finances in less than five minutes.

Free resourcesKeep reading the latest NEWSLETTERS

How to cycle sync your finances