Use this tax tip to put more money in your pocket this year

THE STACK #1First of all, HAPPY NEW YEAR! Second of all, welcome to the very first issue of my newsletter THE STACK!!!

I will be sharing savings/investing tips, money tools/resources, motivating you, helping you stay accountable and a few occasional rants!

Expect to get your STACK every Wednesday #consistency.

So let's get into the tea!

THE STACK

Did you know that instead of waiting until tax time for a refund, you can reduce your taxes at source instead?

Yup! I used this tax hack to save $277 every paycheque, putting back $7,202 in my pocket in 2021.

This was extra money I could invest, and I'm so glad I did this because the stock market in 2021 returned over 26%.

I heard someone say that your refund is an interest-free loan to the government, and boy were they right!

If you intend to claim any of these tax deductions and tax credits, you can make a request for your taxes to be reduced at source using the T1213 Form:

RRSP

Charitable donations (this includes tithes to church)

Childcare expenses

Employment expenses

Medical expenses

Support payments

Clergy residence

Foreign tax credit

Moving expenses

Tuition

Education

Rental loss

Carrying charges and interest on investment loans

If you know the amount you will claim for each of these deductions/credits (see why budgeting is essential?), you can claim them in advance.

Instead of waiting for tax time to claim these amounts on your taxes and getting a refund, you can claim this deduction immediately.

This reduces upfront the taxes your payroll withholds from your paycheque, instantly giving you more money back each month.

Fill out the T1213 form and submit it to the CRA

You must fill out the form and send it to the CRA for approval.

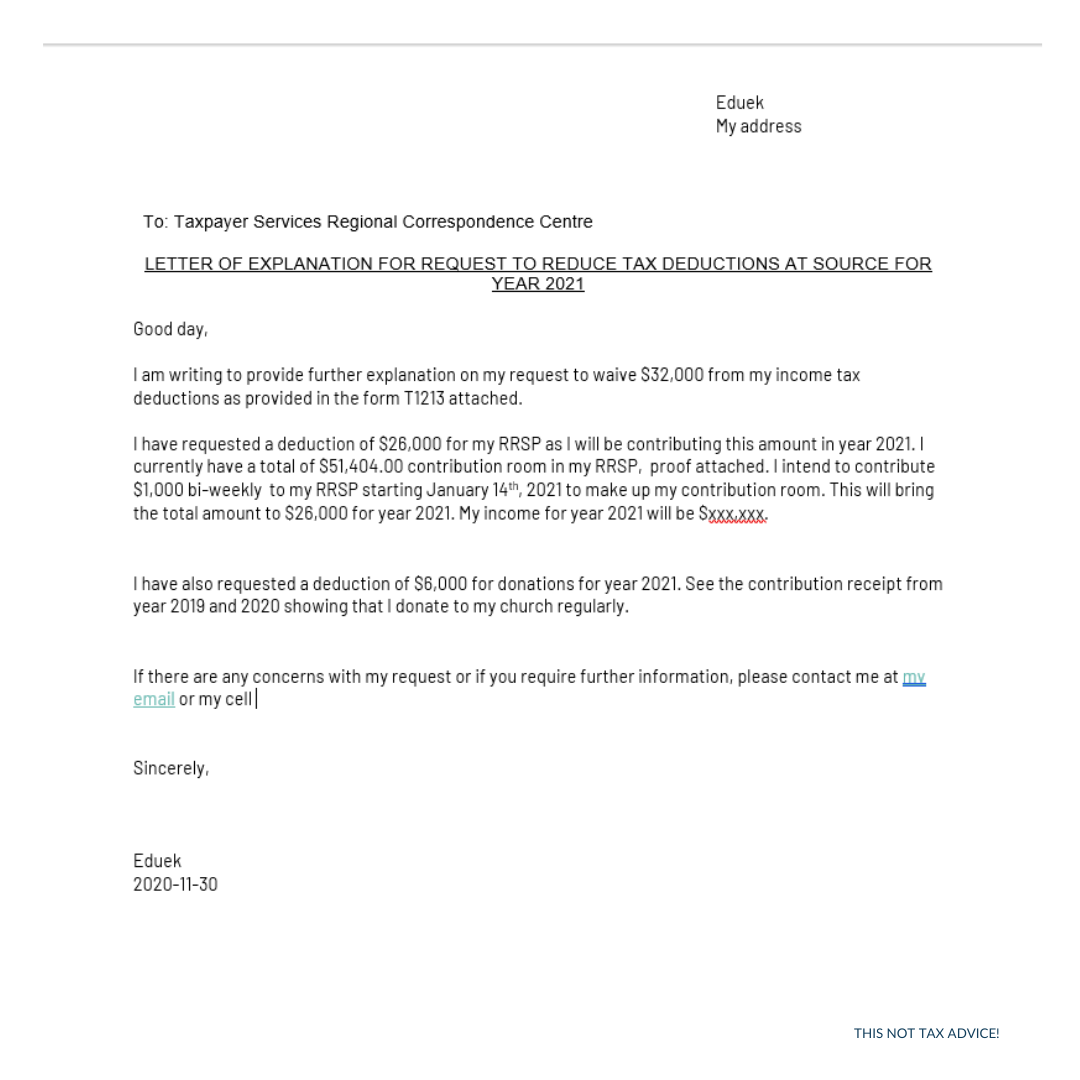

You will need to write a letter of explanation as well as provide supporting documents to show that you will have these claims (receipts of past contributions will do)

Here is a sample of the application I submitted for the 2021 tax year

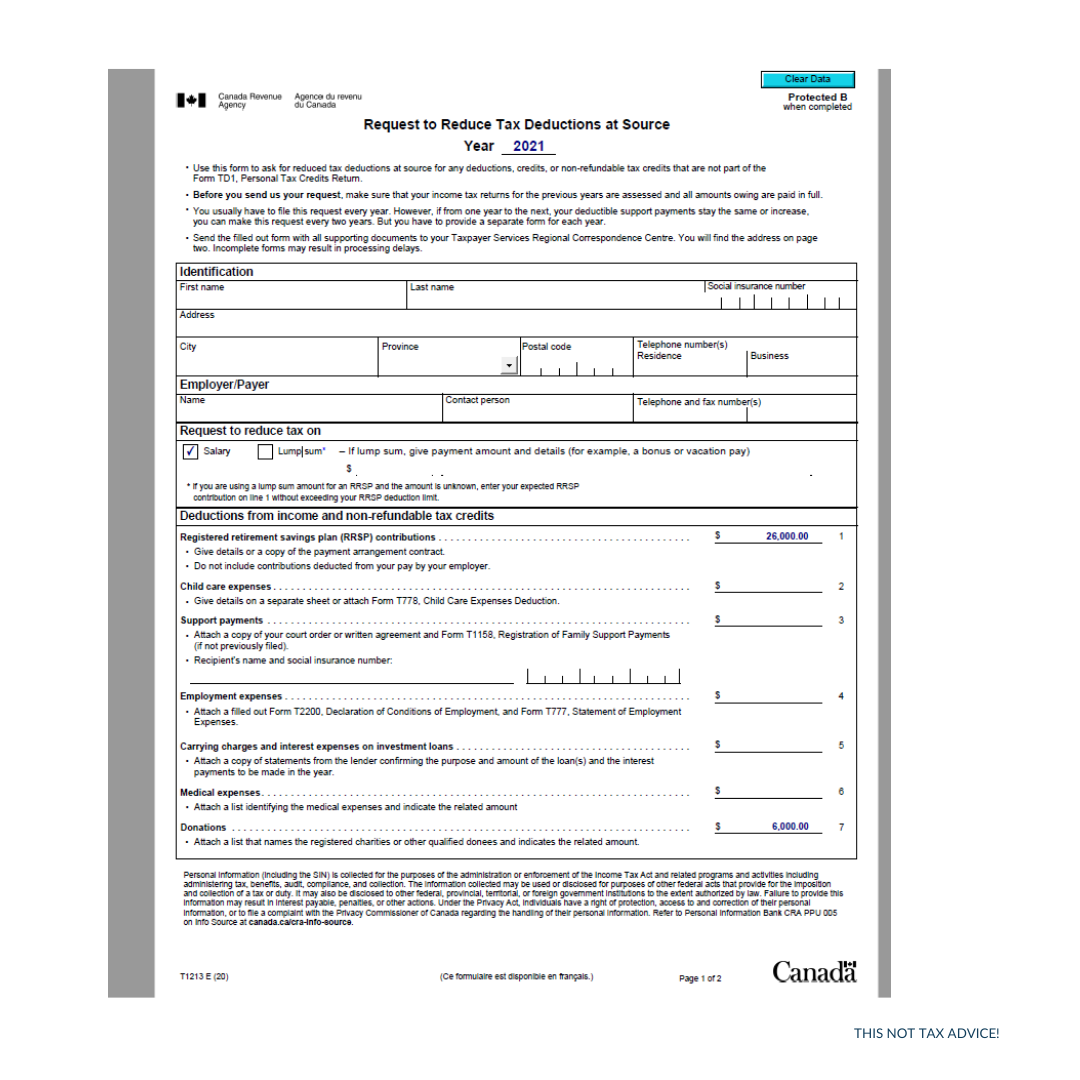

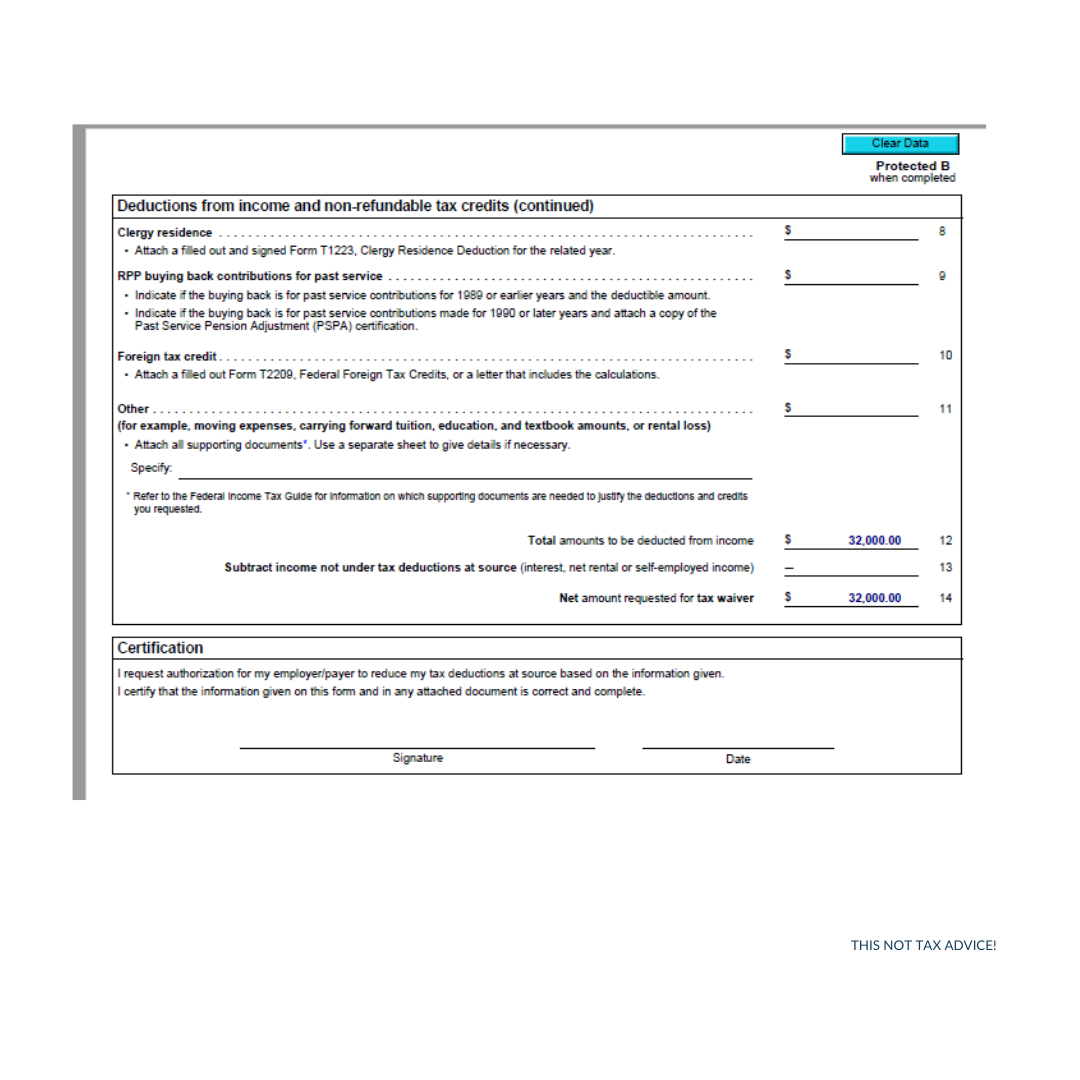

and here is a sample of the form I filled out:

Like all CRA-related things, it takes about 2-3 months to hear back.

If you get approved, you will receive a letter with a detailed breakdown of how much taxes should be deducted from your paycheque.

The letter will be addressed to you and your employer.

Here is the letter that was sent back to me.

Submit the letter to your payroll, and you should see the changes reflected in your next pay stub, depending on your pay cycle.

Important Disclaimer

You have to make the contributions you claimed.

If you promised to contribute $10,000 into your RRSP, you have to contribute that amount or else you MIGHT OWE TAXES come tax time.

THIS IS NOT TAX ADVICE.

Please talk to your accountant to ensure this makes sense for your situation.

What should you do with the extra cash flow?

You can use the extra cash flow to:

Pay off debt

Invest

Save for a big purchase

Stop stressing!

THE TOOL

Want to know how much taxes you can save from your tax deduction? I use this free income tax calculator from Turbotax.

You can enter your income and your potential deductions to see how much you can get back from your tax deductions. This is a tool I like to use at the start of the year to figure out how much I need to contribute to my RRSP.

THE ACCOUNTABILITY

The RRSP deadline for the 2022 tax year is March 1st, 2023

THE COURAGE

THE KNOWLEDGE

TAX DEDUCTION

A tax deduction reduces the amount of income that is subject to taxes.

Example: You have an income of $50,000. A tax deduction (such as an RRSP contribution) of $5,000 will reduce your taxable income from $50,000 to $45,000.

TAX CREDIT

A tax credit reduces the amount of tax owed.

Example: You have an income of $50,000 and owe $10,000 in taxes. A $2,000 tax credit (such as charitable donations) will reduce your taxes from $10,000 to $8,000.

That's it for this week's STACK!

Talk to you next week,

But until then...Keep Stacking!

about the newsletterEvery Saturday, subscribers will receive one money tip, one tool, one actionable step, one word of courage and learn a new finance term to help you gain control of your finances in less than five minutes.

Free resourcesKeep reading the latest NEWSLETTERS

How to cycle sync your finances